Forex rigging has cost banks dear with regulators issuing multi-billion dollar fines and individual traders facing criminal prosecution. Investor litigation in the wake of manipulation of the foreign exchange markets now threatens to add further to the financial and reputational toll of the scandal. How does such market manipulation take place and what role can surveillance tools play in detecting this illegal behaviour?

The vulnerability of the largely unregulated Forex market to market manipulation is highlighted by two main forms of trading behaviour associated with Forex rigging: “Banging the close” and collusion.

Banging the close

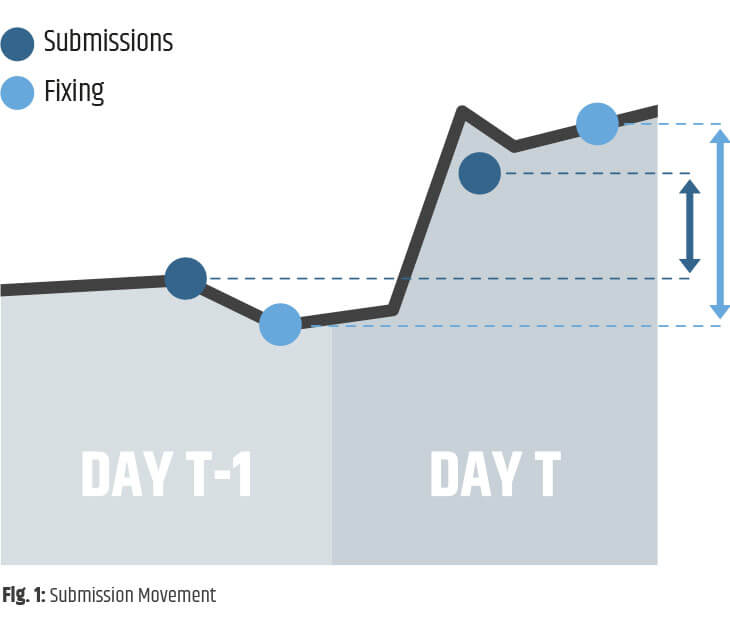

Traders can influence the market by submitting a rush of orders during the ‘fix’ window, thereby giving a false impression of supply and demand, moving the price in their favour.

Collusion

If several traders collude to share information and place orders at the same time during the fix window, the impact on price movement can be even more dramatic, producing greater potential profits for traders in collusion. The most advanced market surveill- ance solutions will have the capability to identify and report suspicious trading activity of this kind. A lot of daily benchmark rates are calculated based on trading activity so it is important that compliance monitoring is implemented. However, some benchmarks are still calculated based on a bank making a submission (often verbal) so there‘s a need for participants to implement monitoring solutions for this type of activity too.

Automated surveillance systems can alert compliance officers early on, by identifying suspicious situations based on a number of pre-defined scenarios. In the case of Forex, surveillance tools can identify suspicious trading activity at or around the time of the fixing. Such solutions will typically provide alert analysis including market data, covering global trading activity aggregating and analysing data from across all time zones, allowing for cross linking between all parts of a global institution.

Market abuse is a moving target, so while there are software solutions that can help institutions to protect themselves against forex rigging, the need for flexibility will remain constant. More- over, with ever increasing regulation and unknown future fraudulent forex rigging scenarios yet to come, a dynamic and urgent approach to benchmark analysis of potentially fraudulent activity must now be an essential priority.